Story Highlights

• The Supreme Court signaled reluctance to allow the immediate removal of a Federal Reserve governor.

• The case tests the limits of presidential authority over independent agencies.

• Markets are watching closely for implications for Fed independence.

What Happened

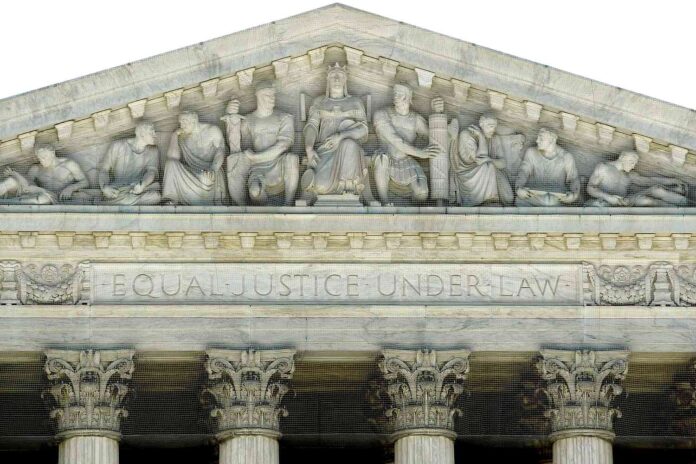

The U.S. Supreme Court signaled hesitation about granting President Donald Trump the authority to immediately remove a sitting Federal Reserve governor, according to reporting on recent court proceedings. The justices’ comments suggested concern about disrupting long‑standing legal protections that shield independent agencies from direct political interference.

The case centers on whether the president can dismiss a member of the Federal Reserve before the conclusion of a fixed term. Lawyers for the administration argued that executive authority should extend to such removals, while opposing arguments emphasized the importance of maintaining the Fed’s independence from political pressure.

Rather than issuing an immediate ruling, the court’s posture indicated a cautious approach, leaving existing arrangements in place while the broader legal questions continue to be examined.

Why It Matters

The Federal Reserve plays a central role in managing inflation, employment, and financial stability. Its credibility depends heavily on independence from short‑term political considerations, particularly during periods of economic uncertainty.

A decision allowing the president to remove Fed governors more easily could alter how markets perceive U.S. monetary policy, potentially increasing volatility. Conversely, preserving current protections reinforces confidence that interest‑rate decisions will remain driven by economic data rather than political priorities.

For investors, even signals from the Supreme Court can move markets by shaping expectations around future policy stability.

Political and Geopolitical Implications

Politically, the case reflects broader debates over the balance of power between the presidency and independent institutions. Supporters of expanded executive authority argue it enhances accountability, while critics warn it risks politicizing economic management.

Geopolitically, confidence in U.S. institutions underpins the dollar’s role as the world’s primary reserve currency. Any perception that monetary policy could be subject to political influence may affect global capital flows, foreign investment, and international financial stability.

The court’s cautious tone suggests awareness of these broader consequences beyond the immediate legal dispute.

Implications

If the Supreme Court ultimately limits presidential removal authority, it would reaffirm long‑standing legal protections for the Federal Reserve and similar agencies. Such an outcome would likely reassure markets and global partners about the durability of U.S. institutional independence.

If, however, the court later sides with expanded executive power, it could mark a significant shift in how independent agencies operate. Until a final ruling is issued, uncertainty will persist, keeping legal experts, policymakers, and investors closely focused on the case’s next steps.

Source

Supreme Court signals reluctance to allow immediate removal of Fed governor